Colonial American currency was a work in progress from the time of the earliest English settlements of the 1600s until the United States of America minted its own money in 1783. The monetary system was far from standardized, and trade within the colonies often relied heavily on the barter system and cashless transactions than exchange of coins or banknotes.

The English colonies of North America were all established at different times and by different people, some by royal charter, others by private charters, and the British government had no desire to grant its colonies the right to mint their own currency nor to export quantities of silver coin to them. This situation led to a wide variety of different currencies that could be used for local transactions and difficulties in trade between the colonies and their mother country.

The Spanish dollar was in wide circulation and would be accepted in, say, South Carolina but not necessarily in Massachusetts. Tobacco was widely accepted as a form of currency but, again, not uniformly. A brass button from a gentleman’s coat might serve to purchase dinner and drinks at a tavern in New York but that same gesture might be laughed at in Connecticut. Transactions, therefore, took on many different forms regarding acceptable payment for goods and services, even though it was understood – across all the colonies – that prices were based on the English pound sterling, and currency fell into three categories acceptable in trade:

- Specie – coins, mainly the Spanish dollar

- Paper Money – fiat money, land notes, banknotes, tobacco notes

- Commodities – goods or services offered in trade

Specie and paper notes were denominated in pounds, shillings, and pence but the value of a pound in Connecticut was not the same as in Virginia. People still used pounds, shillings, and pence in pricing an item or service, but that pound, shilling, and pence had a different value colony to colony because each had its own government, made its own laws, and defined what their currency was worth. A common method of payment, therefore, was in commodities such as tobacco, alcohol, lumber, or labor. A man might pay for lumber by sending his servant to build the seller a fence or chicken coop or purchase his wife a new dress for a quantity of tobacco. This practice worked well enough in a given village in a specific colony but not always colony to colony. Problems with trade arose when someone in, perhaps, New Jersey, tried to pay for rice from South Carolina with some commodity the seller rejected.

Attempts were made in the colonies to rectify this, notably the minting of the pine tree shilling by John Hull (l. 1624-1683) in Massachusetts in 1652, but, even though this helped, there was still no standardization of currency across all of the colonies. Even bank notes backed by the value of real estate were not always accepted (though usually they were). It was not until after the American War of Independence (1775-1783) that the first standardized currency was struck in the United States of America which set the model for the country’s economic foundation going forward.

English Colonies & Currency

Each of the Thirteen Colonies was its own political entity founded for specific reasons and at different times. Jamestown Colony of Virginia was the first successful English settlement, established in 1607, and followed by Plymouth Colony of Massachusetts in 1620. Massachusetts Bay Colony was founded in 1630, and the other New England Colonies then developed from that. The Middle Colonies were controlled by the Dutch until 1664 when they were taken by the English, and Pennsylvania was founded later in 1681. The Southern Colonies, besides Virginia, were established between 1632-1763, and these, like the others, had their own ideas of what constituted currency.

In the New England Colonies, especially Massachusetts, wampum was accepted as payment for goods and services between 1643-1660. Wampum was belts, sashes, and strings of polished shells and beads forming a specific design and, usually, telling a story and had been used as currency among Native American tribes. When the colonies attempted to pay debts to England using wampum, however, the British government rejected it and ended the practice.

Paper money, especially fiat money, was not always accepted. Fiat money’s value is based on the confidence one has in the issuing party, as explained by scholar Charles C. Mann:

Fiat money has no intrinsic value and is worth something only because the government declares it is. The U.S. dollar is an example, as is the euro. As pieces of paper, dollar bills and euro bills are next to worthless. Yet because they are officially printed by government institutions, people can hand these colorful paper rectangles to grocery-store clerks and walk out with bags of food. (172)

Unlike fiat money, commodity money held value because of the material it was made from – gold or silver – and although commodity money in the form of the Spanish dollar circulated widely in the colonies, it was not recognized at the same value colony to colony. Land notes, paper money backed by the value of one’s land were more or less reliable and widely used in the Middle Colonies. A farmer would go to a land office and take out a loan using their land as collateral. The loan would be given in land notes which the farmer could use in trade. If one failed to pay off the loan in whatever commodity was agreed to, the land office foreclosed on the land and sold it.

One of the most reliable commodities to pay off a loan, or pay for anything else, was corn, as explained by scholar Alice Morse Earle:

We ought to think of the value of food in those days; and we may be sure the governor and his council thought corn of value when they took it for taxes and made it a legal currency just like gold and silver and forbade anyone to feed it to pigs…The corn had a steady value, it always furnished just so much food; and really was a standard itself rather than measured and valued by the poor and shifting money. (138)

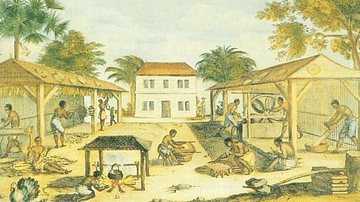

In the Southern Colonies, tobacco was the most widely accepted form of currency and allowed one to trade on its value for necessary items and luxuries. A farmer would bring his dried tobacco product to an inspection site overseen by the local colonial government, and if it was of acceptable quality, the inspector would issue the farmer a writ for a certain amount. The farmer would use this writ (known as a tobacco note) to purchase goods and services from others in the community. The colonial inspectors and merchants would then ship the tobacco to England and British merchants in London would send back goods requested by the colonists.

The British government and merchants did not send back gold or silver coins, however, and very little British currency circulated in the colonies. The government mandated that the colonies should send the mother country valuables, not the other way around, and they were not about to export massive amounts of silver in breach of this mandate. Further, the colonies were on the losing end of the balance of trade because the goods they exported to England did not match the monetary value of those they imported. The goods they received for their exported tobacco, for example, were sent with the understanding that the tobacco was worth the same monetary value, but this was not always so.

Tobacco might get wet or go stale on the voyage to England or the merchants might have a very different definition of the quality of the tobacco, even in pristine condition, once it arrived. In these cases, the colonists would have to pay the London merchants the difference. Even if the tobacco was accepted at the price the colonists set without problems, the commodities sent were still valued at a higher rate, and colonists were expected to pay, not only the difference but also import/export fees in silver coin.

Problems with Trade

The most common coin in circulation throughout the colonies was the Spanish dollar in the form of coins known as ocho reales (better known as“pieces of eight”) which came to the colonies through trade with the Spanish from their colonies in the West Indies and Mexico. Goods were valued in English pounds but could be purchased with Spanish dollars. The value of a Spanish dollar was 54d (the d standing for denarius, the Latin word used to designate a pence) but that value differed from place to place. A Spanish dollar might be worth 54d in Massachusetts but not in New York and not in London. London’s valuation, especially, differed from the colonies’ significantly, and a shilling might be worth 16d in London but only 12d in Massachusetts.

Further complicating colonial currency was the practice of 'crying up' or 'crying down' a certain coinage. There was no mark on a coin indicating nominal value – value was given by the sovereign entity issuing the coin – so by reducing or inflating the value of a coin by proclamation, the sovereign entity could change the value. London could, and did, cry down certain coinage and cry up others and also set the rates for export and import duties. Colonial merchants, who had to pay these rates in silver, consistently found themselves short because of London merchants crying down the shilling.

There was nothing the colonists could do about these problems of trade with England because the British crown made all the rules which favored the mother country. The Navigation Acts of 1651 (strengthened in 1660 and 1663) outlawed trade by the colonies with any but English ships commanded by English captains with a majority of English as crew and so hampered trade between the colonies and Spain, cutting off the supply of Spanish dollars.

In an attempt to make up for this loss of coin, the legislature of Massachusetts Bay Colony decided to mint their own money. In 1652, Captain John Hull was authorized by the colonial government to mint the now-famous pine tree shilling (so-called because of the imprint of a pine tree on it, representing a major export, lumber, of the colony). The pine tree shilling was struck in denominations of 3d, 6d, and one shilling.

The coinage served its purpose, standardizing currency in Massachusetts as well as providing actual coins for trade with other colonies, but it was considered unlawful by the English government and so could not be used in trade with London. To get around any legal issues, Hull ordered all coins, no matter the year minted, to be struck with the date 1652 when the English government was a commonwealth and had no sitting king to prohibit a colonial mint. The coins continued to be minted from 1652-1683 when the mint was shut down by order of King Charles II of England (r. 1660-1685) after the monarchy was restored. Charles II regarded Hull’s minting of coins as an act of high treason but neither Hull nor his assistants were charged or prosecuted in any way nor did the government recognize the economic problems that had led to the mint.

Currency Acts

In 1690, Massachusetts again tried to resolve the currency problem by printing and issuing fiat money. This was done primarily to pay off the colony’s debts to the crown for military expenses incurred by King William’s War (1688-1697), which was the North American theater of the Nine Year’s War fought between England and France in Europe. The colonists had not started the war but were required to help finance it and recognized it was in their best interests to do so owing to the threat of the Native American Wabanaki Confederacy, who were allied with the French, attacking English settlements.

The fiat money was issued with the colonial government’s promise it would be accepted as legal tender in trade and could be used to pay future taxes which would take the bills out of circulation. Some colonies recognized that they needed to be careful in how much of this currency was issued, taking into consideration future tax bills which would withdraw the bills from circulation, but many did not. Colonies that correctly gauged bills printed against future tax receipts did well, but those that did not wound up issuing more bills than could be legally withdrawn (and then disposed of) for taxes. This resulted in widespread inflation as people’s confidence in the buying power of the fiat money evaporated. More bills had been issued, and in greater denomination, than the colonial governments could back, and by the time the problem was fully realized, fiat money was in wide circulation.

The English government would most likely have done nothing about this problem, following their usual course of ignoring colonial grievances, but it began to affect English merchants in London who were forced to accept the depreciated bills from the colonies in payment. The Currency Act of 1751 legislated the use of the bills as legal tender only for paying taxes, not for private transactions. This law was extended by the Currency Act of 1764, which allowed the colonies to print and issue paper money but prohibited them from valuing the bills at the status of hard coin in gold or silver. The paper money issued by the various governments was backed by a colonial government’s credit, not by hard cash, and British creditors would not accept it in trade, devaluing the money and encouraging further economic problems in the colonies.

Conclusion

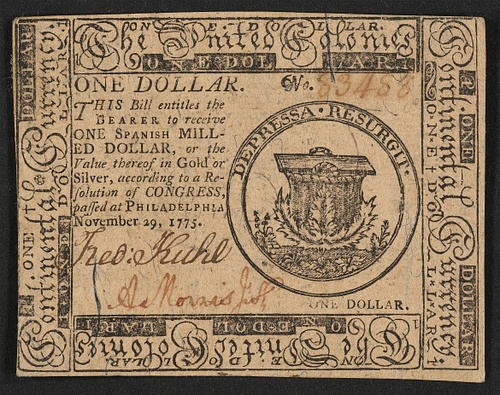

The economic problems of the colonies and the colonists’ grievances, repeatedly ignored or downplayed by the English government, contributed to the tensions that finally erupted in the American War of Independence in 1775. After the Revolution began that April, the Continental Congress issued their own paper money – fiat money – known as Continentals or Continental Currency. These were denominated in dollars in keeping with the Spanish dollar (which is why the American dollar is known as a dollar) but were still valued at the English pound and printed in denominations up to bills of $80.00.

The Continental Congress had either forgotten or ignored the problems of 1690 onwards caused by printing too many bills to take out of circulation through taxes and also failed to coordinate a central point of issuance, resulting in various colonies continuing to print and issue their own bills. The fiat money depreciated badly because there were too many in circulation to hold their value. This problem was compounded by British counterfeiters in New York who sent agents with fake bills throughout the colonies so that, by 1778, a Continental was worth less than half its face value, and by 1781, the fiat money was practically worthless.

In an effort to save the economy, Congress appointed the merchant Robert Morris (l. 1734-1806), one of the signers of the Declaration of Independence, as Superintendent of Finance of the United States. Morris, with the assistance of Alexander Hamilton (l. c. 1757-1804) and Albert Gallatin (l. 1761-1849), created the Bank of North America in 1782. The bank was funded by hard currency loaned by France which had allied with the colonists against the English in 1777. Morris’ efforts financed the colonial war effort from 1782 until victory over the British in 1783 when he presided over the minting of the first currency of the United States of America, known as the Nova Constellatio. To prevent future problems, states were prohibited from minting their own money and devaluing the currency; only the federal government could mint and issue legal tender. The banking system devised by Morris, Hamilton, and Gallatin, and adopted by Congress, has continued to serve as the model for United States’ banking and economics from that time to the present day.